Please look closely at this document:

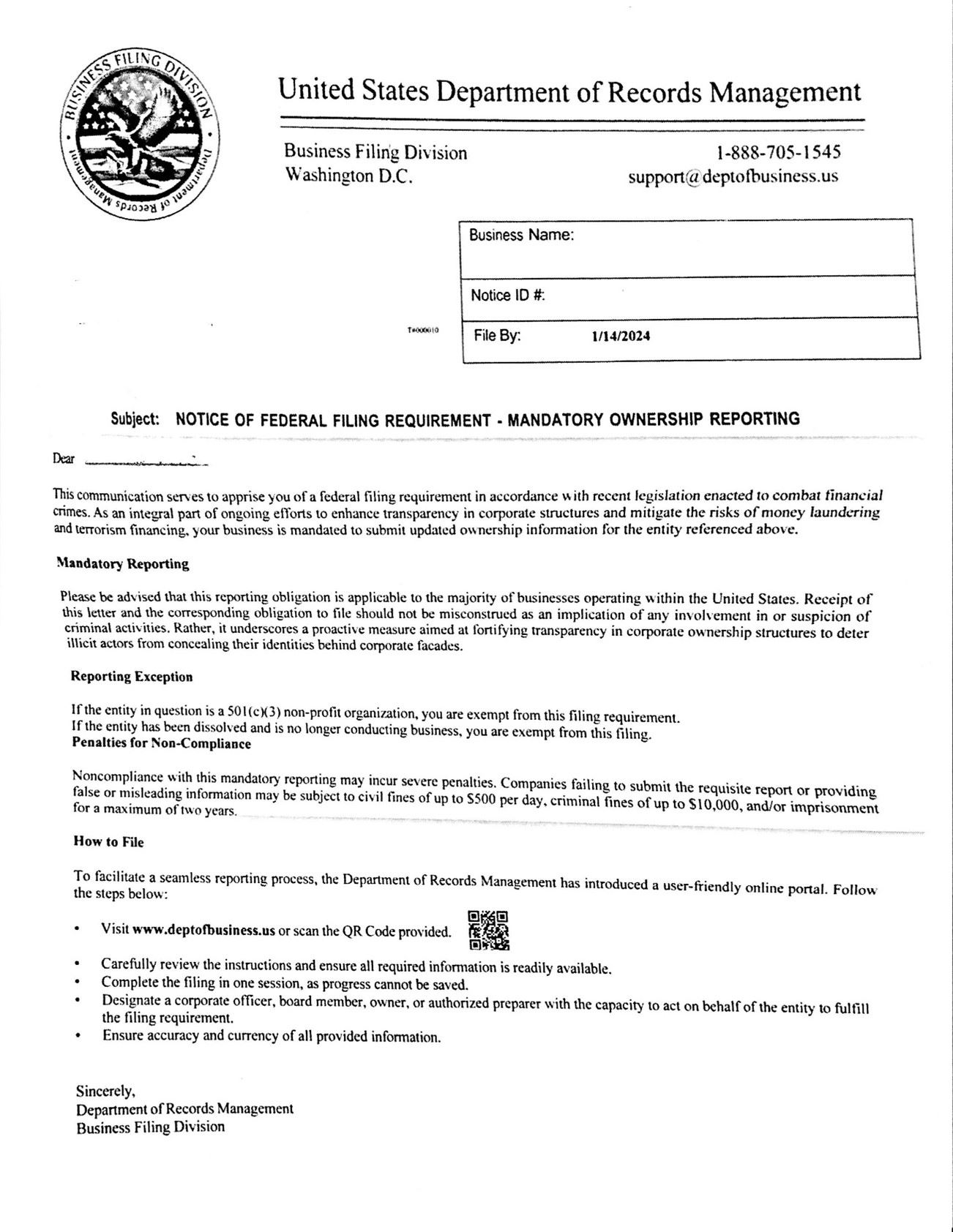

If you own a business, either an LLC or a corporation, you can expect to receive this or similar solicitations in the mail.

The document above is a scam. It is intended to trick you into disclosing protected information, including the Social Security Numbers of your business’s owners, and to pay supposed “filing fees” you do not owe.

This scam tries to take advantage of the new federal Corporate Transparency Act, which takes effect on January 1, 2024. This Act requires all small and medium sized businesses to file with United States Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”), Beneficial Ownership Information (“BOI”) on each business. For all businesses formed before January 1, 2024, the first filing deadline is not until January 1, 2025.

To file the initial report, business owners need to collect private information from everyone who owns 25% or more of the business entity. For each person, here is what you will need to collect, store, and file with the federal government:

- Full legal name

- Date of birth

- Complete current address

- A copy of a State driver’s license, a U.S. passport, or other government-issued ID.

But, there is an important work-around. Any individual can get their own “FinCEN identifier,” and once they have that, that FinCEN identification number can be used on these BOI reports, instead of having to provide for each individual owner their date of birth, current address, and government ID.

So, after January 1, 2024 everyone should go online at the FinCEN website, and get FinCEN identification numbers. Then when you form new business entities, rather than acquiring and reporting all of that personal information, you can just give the FinCEN number for each of your owners.

This is not like an Annual Report. You do not have to file with FinCEN every year. However, if your ownership changes, if the owners’ addresses change, or owners move and get new driver’s licenses, the information has to be updated with FinCEN.

To obtain a FinCEN Identifier, go to www.fincen.gov/boi. Have a driver’s license or passport in front of you, and also scan a copy, because you will need to type in the number and then to file that electronic copy with the feds. After you submit an application, you will immediately receive your FinCEN identifier.

Jesse Jones

Dec. 28, 2023

.2402261628374.png)